Business Systems Applications

Finance

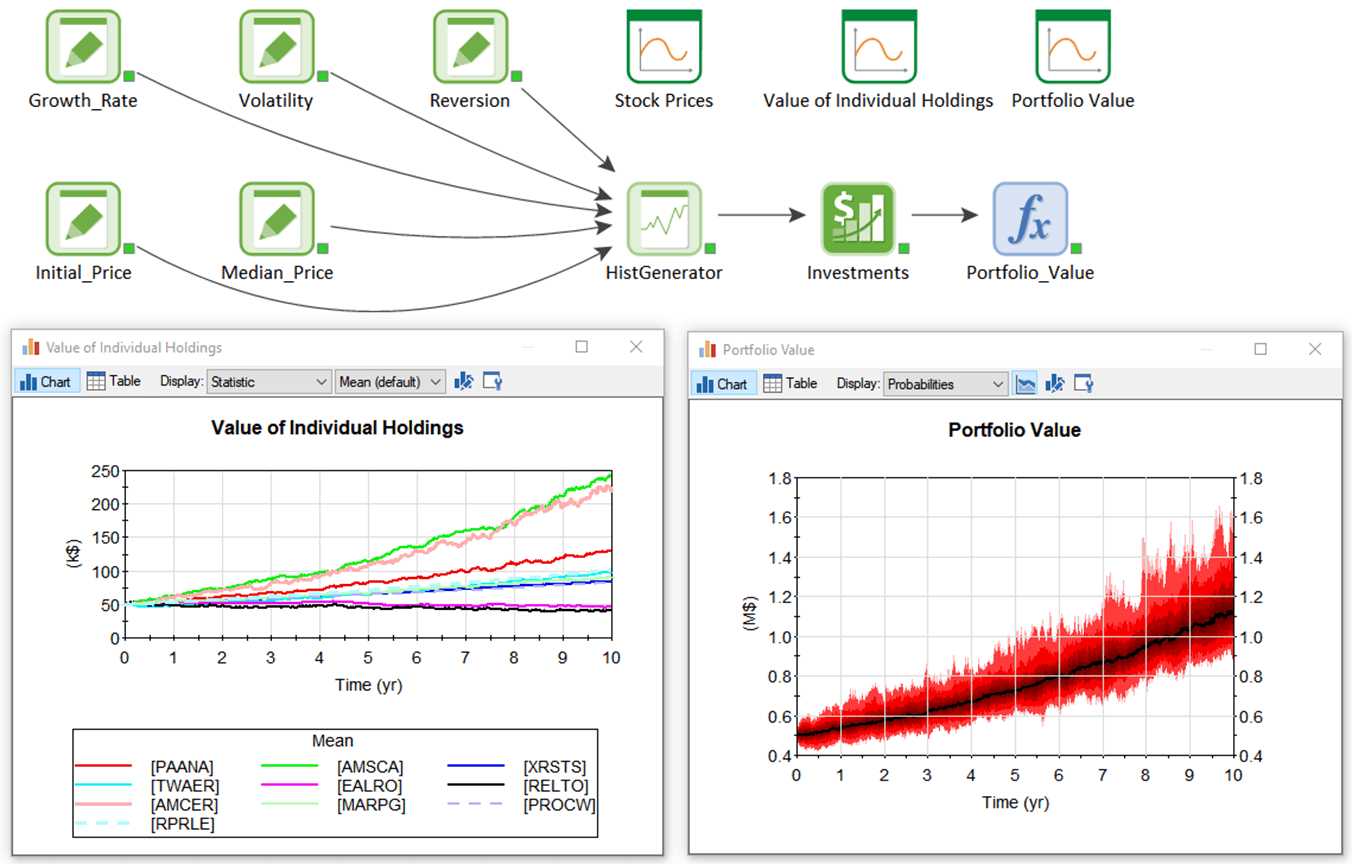

Using Simulation to Support Financial Engineering and Risk Management

Financial engineering focuses on the management of financial risk. It consists of the application of the mathematical tools commonly used in science and engineering to financial problems and managing treasury risk, especially the pricing and hedging of derivative instruments such as futures, swaps and options.

By combining the flexibility of a general-purpose and highly-graphical probabilistic simulation framework with specialized features to support financial modeling, GoldSim software is ideally suited as a financial engineering tool.

With GoldSim, you can:

- Respresent stochastic variables and uncertainty. By its very nature, financial engineering deals with stochastic and uncertain systems. GoldSim has powerful features for representing stochastic processes and uncertain variables.

- Represent random discrete events. In the real world, sudden events or developments can completely change the outcome of certain strategic decisions. GoldSim has the capability to represent random discrete events, such as new technological advances, lawsuits, or natural disasters, that can play a critical role in determining which financial engineering approach is most robust and effective to forecast risk.

- Build top-down hierarchical models. GoldSim allows you to construct hierarchical multi-layer models that represent greater detail at lower levels in the model structure. As a result, you can build, explore, and explain highly complex models without losing sight of the big picture.

- Dynamically link to external data repositories. Financial engineering simulations often require large amounts of input data. GoldSim proives the ability to link to the spreadsheets and database systems where this information is stored.

- Create easy-to-understand presentations that effectively communicate the structure of your model and the results. The best-designed financial model probably won't be implemented if your audience doesn't understand them. GoldSim's user-friendly graphical interface provides you with the tools to communicate with and convince your audience.

Learn More

- Compare GoldSim to spreadsheet modeling approaches