Business Systems Applications

Risk Management & Insurance

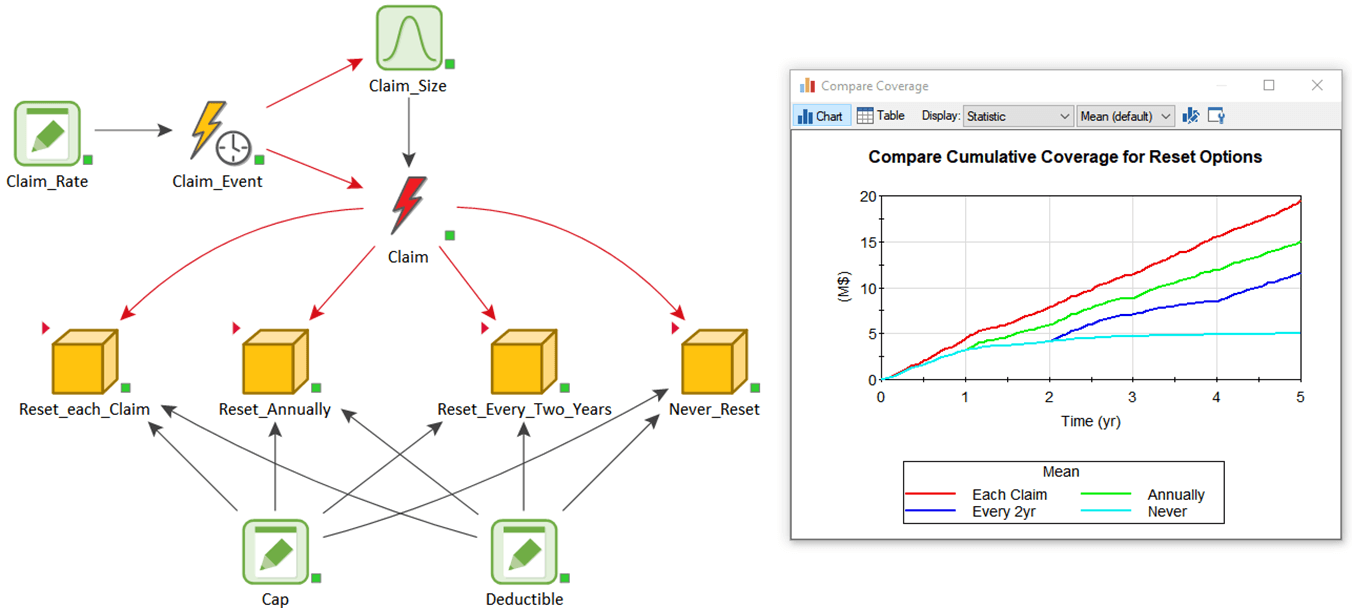

Using Simulation to Support Risk Management and Insurance Claim Modeling

Risk management involves the application of management policies, procedures and practices in order to identify, reduce and/or control exposure to various types of risk. In the business world, this typically encompasses a wide variety of actions, such as implementation of specific business procedures (e.g., health and safety rules), use of appropriate insurance policies, and financial hedging.

By combining the flexibility of a general-purpose and highly-graphical probabilistic simulation framework with specialized features to support financial modeling (including the modeling of insurance claims), GoldSim allows you to create quantitative and transparent business models to support your risk management efforts and make better decisions in the face of uncertainty.

Some of GoldSim's key features that make this possible include the ability to:

- Incorporate variability and uncertainty. By its very nature, risk management deals with uncertainty about future conditions. GoldSim makes it easy to incorporate variability and uncertainty into your simulations.

- Represent random discrete events. Risk management approaches must plan for sudden events or developments that can adversely affect the organization. GoldSim has the capability to represent random events, such as new technological advances, lawsuits, or natural disasters, that can play a critical role in determining which risk management approach is most effective.

- Create easy-to-understand presentations that effectively communicate the structure of your model and the results. The best-designed risk management plans probably won't be implemented if your audience doesn't understand them. GoldSim's user-friendly graphical interface provides you with the tools to communicate with and convince your audience.

Learn More

- Compare GoldSim to spreadsheet modeling approaches